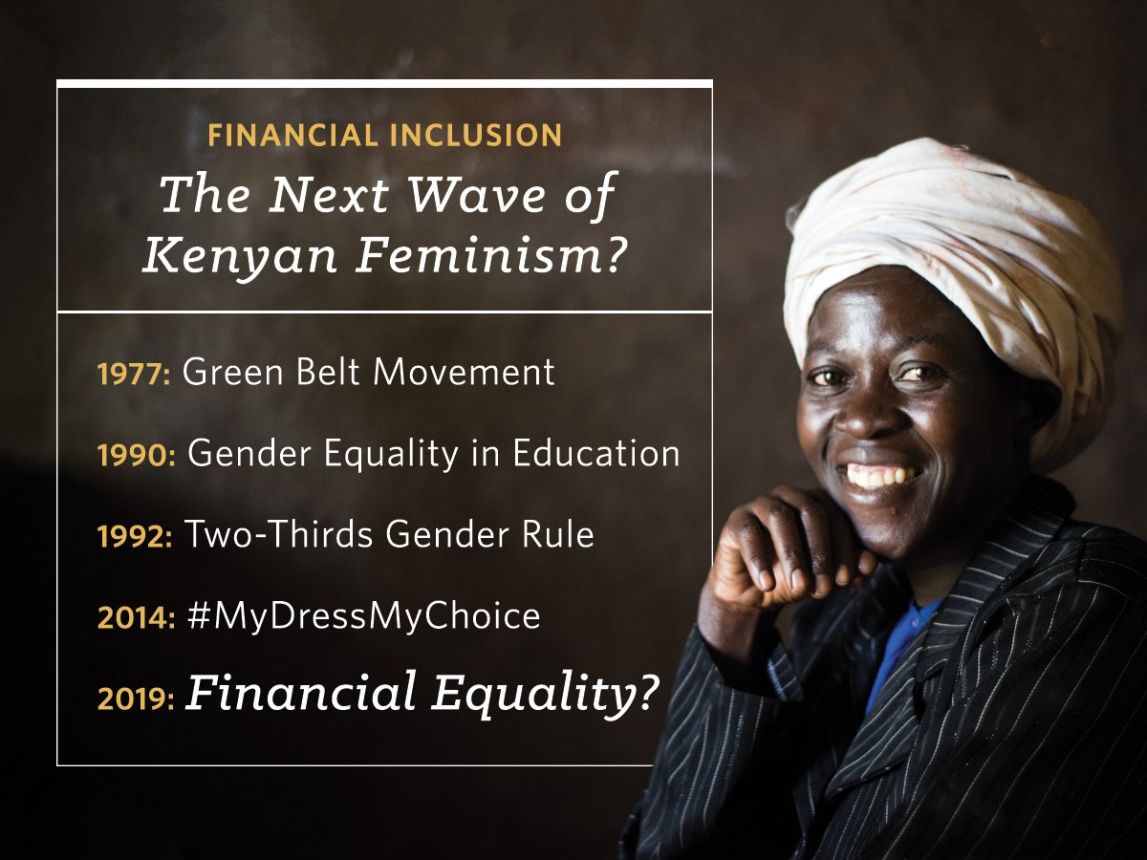

Why Kenyan Feminists Should Advocate for Financial Equality

Women in Kenya still face huge inequalities. Movements like #MyDressMyChoice and #WeAre52pc, advocating for better gender representation in government, have drawn attention to discrepancies in how women are treated and the opportunities they’re able to achieve. However, calls for change have mostly focused on urban areas. In truth, rural women experience some of the starkest inequalities on the planet. This is especially true when it comes to banking and financial services. By and large, Kenyan women have much less access to money than men, and this affects their outcomes in life.

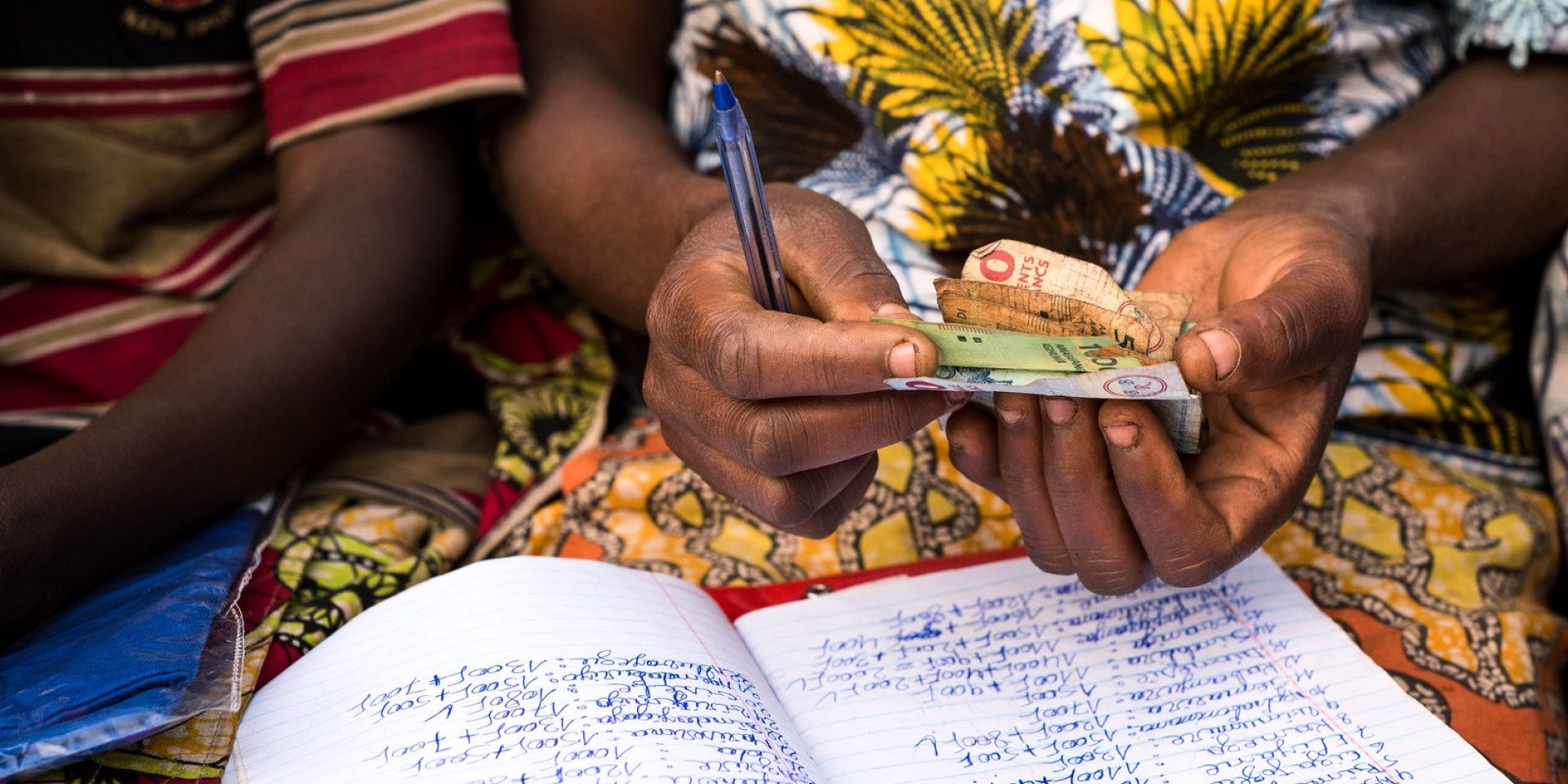

Across Kenya, women represent an outsized portion of the number of people who are unbanked. Close to 20 percent of the total population doesn’t have an account at a financial institution or with a mobile money provider, but women account for about two-thirds of that total, according to the World Bank. The majority of the unbanked come from poor and marginalized communities, often concentrated in rural areas. About 22 percent of the country’s farmers don’t have any access to financial services whatsoever, according to a joint study from the Central Bank of Kenya, the National Bureau of Statistics, and FSD Kenya. There are many reasons why financial access remains difficult for rural women: illiteracy, lower levels of education, lack of land ownership, and socio-cultural restrictions on agency and mobility can all be contributing factors.

So what happens when women can’t access the financial services they need? There can be significant repercussions both for individual women and their families, as well as for society as a whole. Millions of rural Kenyan women earn their livelihoods from farming. Without access to credit, they’re often unable to buy quality seeds, fertilizer, or productive farmland, which in turn translates into lower levels of agricultural productivity. Crop yields in Kenya lag behind global averages, leading to food insecurity in rural areas and lost economic activity. Financial exclusion also means that the poorest households may struggle to feed and educate their children, and financially dependent women can be more vulnerable in cases of domestic violence.

To be sure, Kenya has made great strides in recent years -- financial access has improved significantly nationwide for both men and women. Across the country, about 71 percent of women have some kind of access to formal financing -- usually through a bank or microfinance institution, insurance, or mobile money. That’s up from just 21 percent a decade ago, according to the Central Bank of Kenya study. The biggest driver of this change has been digital technology. Mobile phones have become ubiquitous across Kenya, even in very poor communities, and this has opened up many new opportunities. One Acre Fund has participated in this change -- we’re now providing credit to more than 350,000 farmers in Kenya, and clients can make loan repayments at any time throughout the growing season using their mobile phones. Two-thirds of our clients in Kenya are women.

If more rural women had access to financing, a lot of things could change -- both for individual families and broader communities. Data shows that when women have more money, they are more likely to save it, or spend it on more nutritious food, healthcare, or education for their families. Additionally, financial empowerment has been shown to improve women’s participation in decision-making, critical in combating marginalization. Children from poor communities are less likely to die from malnutrition and have a much higher probability of thriving, when mothers control household finances, according to the Gates Foundation.

While recent progress has been commendable, there’s still plenty of work to do to reach the remaining 29 percent of Kenyan women who only use informal savings groups or don’t have any access to financial services at all. Kenyans who are invested in gender equality and social justice should advocate for rural women in both the public and private sectors. Governments and international groups should know that there isn’t a “one-size fits all” solution, so farm service programs should take specific measures that address disparities in education, mobility, and social discrimination to ensure that girls and women participate and that their participation leads to actual gains in their wellbeing. Financial institutions also have a role to play by designing finance products that meet the unique needs of women, setting ambitious targets for reaching female clients, actively engaging women in male-dominated value chains, and helping build networks that reach local markets where female farmers sell their harvests.

Unfortunately, Kenya is not alone when it comes to gender inequality. At current rates of inclusion, we are more than 200 years away from reaching gender parity globally, according to a recent report from the World Economic Forum shared by the Press for Progress campaign. Progress shouldn’t have to be that slow. If governments, international actors, the financial industry, and informed citizens make concerted efforts to be more gender-focused, we can accelerate women’s empowerment and push toward ending inequality.

This piece was adapted from a column in Project Syndicate by Shiro Wachira, a member of the microfinance partnerships team at One Acre Fund in Nairobi.